by Franklin J. Parker, CFA

The Summary

- The big data point his week is the Federal Reserve’s annual symposium in Jackson Hole, Wyoming. Investors are somewhat divided in expectations for the meeting. Some expect the Fed to make clear the timetable for tapering asset purchases. Other seems to expect nothing new to come from this meeting, that the Fed will make an announcement in their September meeting. Option markets seem to indicate that this will be a non-event.

- The Fed’s meeting minutes posted last week. It showed that several FOMC members are eager to begin tapering, and markets repriced the timing. The consensus is now that the Fed will begin tapering in November of this year. Again, as I have repeatedly talked about before, the Fed ending support of markets does not necessarily mean prices will go down. If corporate earnings growth makes up the difference, prices may hold or continue their uptrend, and with earnings season almost complete, this is exactly what we have seen. Corporate earnings have grown by about 85%—much more than expected—but prices have remained mostly flat. This has naturally lowered valuations without hurting price.

- Our current portfolio strategy is flexibility. For now, both earnings growth and the ongoing actions of the Fed are creating a tailwind for markets. Beginning early next year, however, the Fed’s change in policy will turn that tailwind into a tug-of-war between the positive effects of earnings growth and the negative effects of the Fed’s normalization. Positioning will be informed by the ongoing data and market dynamics at the time.

Recession Dashboard

This week, let’s check in on my recession dashboard.

First we have the GDP output gap, which is the difference between the theoretical output of the economy and its actual output. When the economy is producing less than it is able, this figure is positive. When it is producing more than it is theoretically able to, then the figure is negative. Historically, when the gap closes (goes negative), a recession is not too far behind. This is typically the earliest warning we get of a coming recession. As you can see, the figure is firmly in the growth zone.

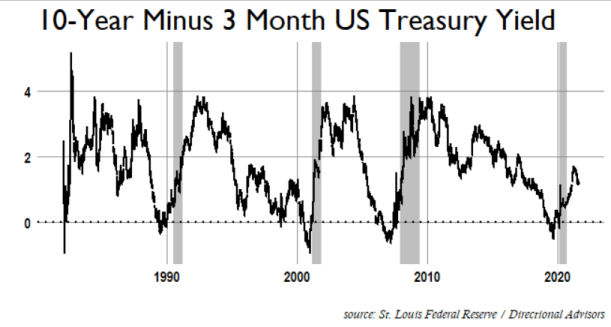

Next, we have the yield curve, one of the most widely-followed recessionary indicators. Normally, investors get paid more to tie up their money for longer. Leading into a recession that relationship inverts, and we get paid more to tie up our cash for shorter periods of time. This indicator has accurately predicted every recession over the past 50+ years. As we can see, this indicator is showing that the economy is in a growth phase.

Another widely-followed indicator is the Headline Unemployment Rate. While the absolute figure is not particularly informative of the business cycle, what we watch for is when the headline rate crosses above its 12-month moving average. When that happens, a recession is typically close at hand. This is now known as Sahm’s Rule after an economist who published a paper a few years ago on the topic. I learned it long before that from an old market veteran. Clearly, the unemployment rate trend is indicating economic growth.

Next we have the Purchasing Manufacturer’s Index, which is an indication of the health of US manufacturing. In this indicator, anything over 50 is expansionary, anything under 50 is recessionary. While we do not always see recessions when PMI is below 50, we have never had a recession when PMI was above 55. Currently, with PMI around 60, manufacturing is going about as well as it ever does. Clearly, PMI indicates an expansionary environment.

Finally, we look at the price of copper. Copper is one of the main commodity inputs to global manufacturing, and its supply is generally pretty responsive to demand changes. Thus, rising copper prices are typically indicative of increased demand for the commodity, reflective of increased global manufacturing. Currently high copper prices appear to be indicative of renewed global demand for manufacturing.

In sum, the macro-economic indicators are showing an economy firmly in an expansionary phase. While there are challenges over the coming months, to be sure, the underlying fundamentals are generally good. If or when this changes, so will my outlook.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Directional Advisors to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professionals, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.